The Value of Job Ads Data in the Location Decision

This article was originally published in Area Development Magazine in Q1 2023.

Job ads are an important tool for understanding the labor market at a prospective location. Individual job ads — as well as statistics gleaned from aggregating job ad trends — allow for identification and analysis of specific competitors as well as gauging the temperature of the labor market for the talent specific to your project.

Why Job Ads?

First off, consider the information a single job ad contains. An ad typically has the employer’s name, the job title of the position that is being advertised, and the location of the job, at a minimum. Usually, a job description is present that can be used along with the job title to categorize the occupation. Ads also generally contain a variety of job requirements, such as educational background, skills, certifications, and experience.

This information in job ads can be used anecdotally, especially relative to specific competitors, but aggregated statistics of these data can also be used to assess an entire labor market or to compare markets.

Besides the variety of data available, another high value characteristic of job ads is their recency — these data, depending on the source, could be at or very near to real-time. Some sources also have historical data that allows for the examination of trends over time as well as providing a larger sample size for research.

Identifying the Competition with the Correct Queries

Before diving into the data, a few tips are in order on how to query the ads. First, don’t define your region too narrowly. The location information from a job ad could be very specific, containing a street address, for example. Very frequently, however, the location information is fairly broad — it is common for an ad to simply refer to the entire market area. For example, an ad may state the location as “Atlanta,” meaning the job is located broadly in the Atlanta market area, not necessarily within the Atlanta city limits. When you are doing your research, therefore, it would be a mistake to focus your region too narrowly, which may miss key talent competitors in the larger labor market.

To find your competitors, you’ll query your database for the same talent that you are looking to hire — the second tip is to experiment with how you perform this search, so your focus isn’t too narrow. You can start by looking up job ads with the same job title, but be careful as some job titles may be company- or industry-specific and will miss similar talent described differently. For example, if you only search for “warehouse worker,” you may be missing competitors looking for the same skills under titles such as “material handler,” “warehouse associate,” or “general labor.” If your database has data organized by an occupational classification system (such as Standard Occupational Classification codes), querying by these occupation definitions may help identify and capture a larger group of job titles similar to your own. Alternatively, you can query by a specific skill unique to the labor force you are targeting, e.g., the ability to drive a forklift may be sufficient for capturing the talent pool you’re assessing.

Once you start querying your job ads data set for the positions you’re looking to hire, you’ll be able to compile a list of the other employers in the region competing for the same talent. If you’re only looking at currently open job ads, be aware that there may be additional competitors out there that are not currently hiring. Expanding the scope of your search over a longer time period can help uncover the broader competitive landscape. You may already be well aware of some of your competitors because they are in your industry. Often, however, similar talent and skills are competed for across many industries, and this type of competitor search will uncover some surprises.

Filtering your searches by specific requirements may be beneficial in better identifying your talent competitors but be aware you may miss some of the market with only this type of query. You may need to hire some drivers with a Commercial Driver’s License (CDL). Only searching job ads for CDL requirements will find some, but not all of your competitors. There may be some employers who hire these types of workers but do not specify the requirement in their ads.

It is a similar story with educational levels. While many employers specify the educational attainment needed for their positions, others will not. That missing requirement doesn’t necessarily mean it is not a requirement for the job; that information may have been omitted for another reason, such as the employer thinking it was unnecessary to specify.

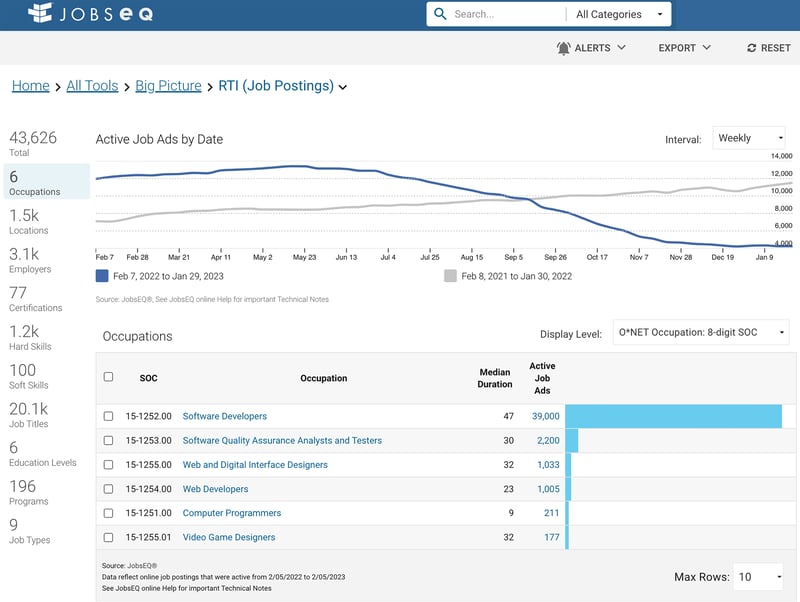

A job posting data set like the Real Time Intelligence analytic in JobsEQ by Chmura can provide a real time look at the types of jobs that are being recruited for in a region now or over a specific time period. The image above shows job postings for software developers in the Seattle-Tacoma-Bellevue, WA, MSA that were active over the last 12 months.

Examining Job Ad Texts

It may take a bit of experimenting with your queries to narrow down and uncover your talent competitors in a region. Once you have them identified, you can then go on to the next step of sizing up the nature of their competition by going through the texts of individual job ads.

For specific employers and positions, you may be able to break out the detailed benefits and wage offerings you’ll be competing against. You’ll also be able to assess which skills and backgrounds your competitors are focusing their recruiting on. Even the cultural tone of your competitors may be evident from the job ads. All these details help paint a more descriptive picture of what the competitive landscape looks like and how that may vary from one site to another.

Aggregate Metrics and Cross-Region Comparisons

Certain summary statistics can be compiled from job ads giving further insight into the labor market, which is especially helpful for comparing overall regional dynamics.

The first of these is the median duration a job ad stays online. Positions that are harder to fill are generally open longer than other positions. Comparing the median duration of ads for the same type of job in multiple market areas can give you an idea of the supply-demand dynamic in those areas. If it takes an average of 49 days to fill a software developer job in Seattle versus 19 days in Dallas, this is consistent with the job market — from the employer’s perspective — being better in Dallas since these positions are filled more quickly on average there. Any single data point can be skewed, however, and large employers in a region with a corporate practice of leaving job ads up for certain lengths regardless of the actual market supply can muddy these duration data. Nevertheless, it is a metric to be considered and taken along with others to inform your decisions and recruiting strategies in a region.

Another aggregate metric is median wages. While many individual ads have wages, the aggregate metric referenced here is the overall average wage in a region based on a collection of ads. These data allow for a broader comparison of wages rather than a simple anecdotal collection of wages. When comparing average wages between two regions, watch out for different characteristics of the ads that may impact those wage comparisons; for example, one region may have more ads for experienced workers versus more entry-level position ads existing in another region. Some parts of the nation have mandated posting wages in job ads, but certainly not all. This could also skew results if employers post very wide wage ranges in areas where such information is mandated.

Some data sets also include an overall demand-supply metric, such as comparing the number of open job ads to the size of the labor pool. The idea with these metrics is to identify where heavier hiring may be taking place relative to the supply of the workforce. Making this kind of comparison can also be performed using job ads data along with a traditional source of employment data such as the Occupation Employment and Wages data from the Bureau of Labor Statistics. For a given occupation, you may see one open ad for every 18 workers in Region A versus one ad for every 37 workers in Region B; this ratio would imply that Region A currently has a tighter market for this particular occupation — in other words, more competition relative to supply.

Site selection is often an exercise in risk mitigation, and using an additional nontraditional data set like job ads can add significant value in real time to labor market analyses specific to a location and in comparing regions, but keep in mind that a superficial analysis can mask underlying trends and actual market conditions. The considerations and guidelines in this article can help you make the most of this resource when you need trustworthy data to make decisions.

Subscribe to the Weekly Economic Update

Subscribe to the Weekly Economic Update and get news delivered straight to your inbox.