Valentine's Day-ta: Spending Could Support $34.7 Billion in Local Economic Impacts

Faced with continued inflation, Valentine’s Day spending is expected to reach $25.8 billion in 2024, according to the National Retail Federation’s annual Valentine’s Day Spending Survey.

That represents a nominal decline from $25.9 billion in 2023, and a changing of priorities. While previous years have seen an expansion in gifts for pets, friends, and co-workers, consumers are expected to prioritize significant others this year to the tune of $14.2 billion (up from $13.5 billion a year ago).[1]

Adjusted for inflation, expected spending

is 16% higher in 2024 than 10 years ago.

The impact of these Valentine’s Day purchases doesn’t just stop at the point of sale. Local spending continues to ripple through the regional economy, supporting additional sales and jobs. Counting up this multiplier effect yields an estimated economic impact of $34.7 billion for local economies.[2]

For example, when a couple goes out for a romantic dinner:

- Their spending directly supports the wages of cooks and waitstaff.

- When the restaurant orders food for dinner service or extend its hours of operation, the Valentine’s Day spending also supports food suppliers (farmers, etc.) and utilities.

- Finally, the restaurant workers spend their wages in the community in areas such as housing, healthcare, banking, and food.

These examples represent the direct, indirect, and induced impacts of Valentine’s Day restaurant spending, and can be extended to other spending categories such as jewelry, flowers, chocolate, or clothing. The graphic below summarizes the direct and ripple (indirect plus induced) effects of such spending.

The Economic Impact analytic in JobsEQ® is leveraged to calculate the total economic impact. Spending is broken up into categories such as jewelry ($6.4 billion), an evening out ($4.9 billion), clothing ($3.0 billion), and flowers ($2.6 billion). After reducing spending by 40% for online purchases made outside the region, the local spending is matched to North American Industrial Classification System (NAICS) codes such as florists (NAICS 4593), restaurants and other eating places (7225), or department stores (4551). Applying the relevant industry multipliers to the spending categories yields the indirect and induced impacts.

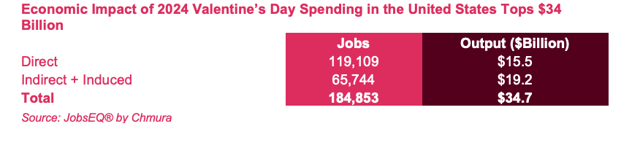

In total, Valentine’s Day spending in 2024 could support more than 184,800 jobs[3] and $34.7 billion in economic output (sales) in the United States. Consumer’s direct Valentine’s Day spending could directly support over 119,000 jobs and $15.5 billion in economic output. As those dollars ripple through the community, holiday spending can support more than 65,700 additional jobs and $19.2 billion in additional economic output in communities across the nation. These data are summarized in the table below. To estimate similar impacts in your own community, use the JobsEQ Economic Impact analytic or contact one of our economic consultants for a custom study.

--------------------------------------------

[1] https://nrf.com/media-center/press-releases/valentines-day-spending-significant-others-reach-new-record-nrf-survey

[2] Excluding online sales (estimated at 40% based on NRF data). While online shopping may impact localities with warehousing, for example, the intent of this analysis is to focus on local in-person spending.

[3] The employment impact can be reflected in existing employees working more hours during the Valentine’s Day holiday. It does not mean all jobs represent new hires.

Subscribe to the Weekly Economic Update

Subscribe to the Weekly Economic Update and get news delivered straight to your inbox.