Restart of Student Loan Repayments May Lead to Slowdown in Consumer Retail Spending

Households with student loan debt will be rethinking spending and saving priorities, and those changes will ripple throughout the economy this holiday season. In early 2020, the Office of Federal Student Aid suspended loan payments in response to the economic hardships brought about by the COVID-19 pandemic. The suspension provided temporary relief to millions of borrowers and allowed them to redirect funds toward other expenses or savings. The resumption of student loans started in October 2023.

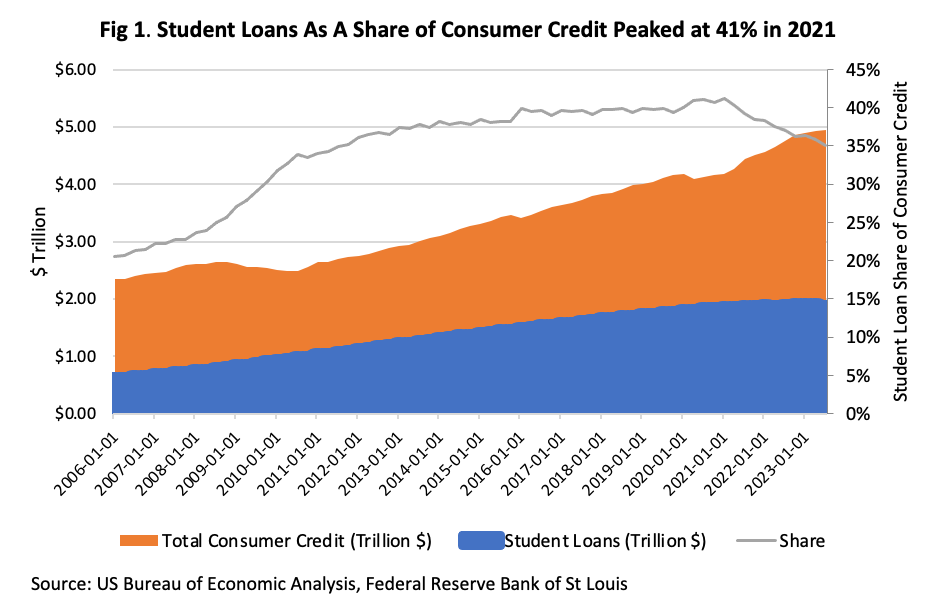

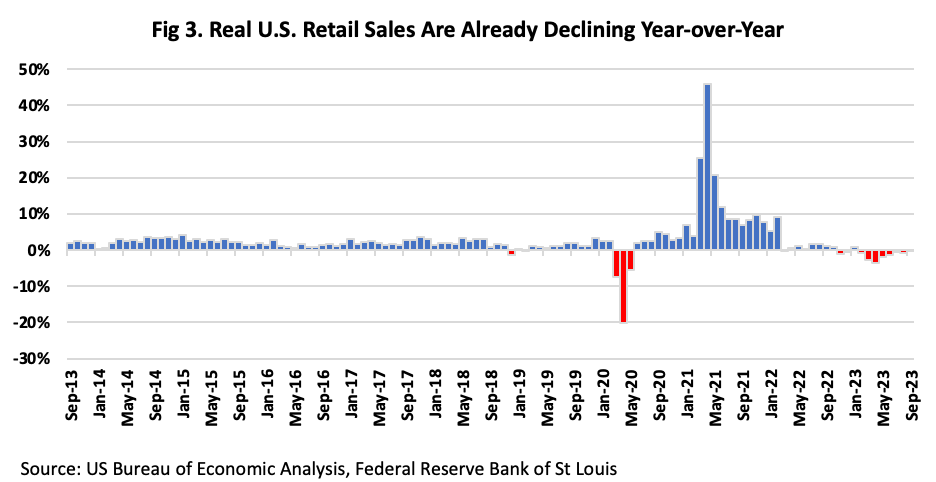

These suspensions, coupled with other factors such as a decline in college enrollment, briefly paused a period of steady growth in student loan debt as a share in total consumer loans (which has been rising since 2006). In the first quarter of 2006, student loans totaled over $480 billion and accounted for 21% of total consumer credit (Figure 1). By the start of 2021, student loan debt accounted for 41% of consumer credit, totaling $1.72 trillion in the first quarter of that year. That share has since declined as student loan growth has slowed in comparison to other consumer loans, with one reason being the decline in capitalized interests following the pause in interest accruement from COVID-era emergency relief programs.[1][2]

Declining college enrollment since the pandemic has also dampened the growth of new student loans.[3] By the third quarter of 2023, student loans made up over one-third (35%) of total consumer credit.[4] Though the share of total credit has declined, the overall student loan amount continues to grow: in total, over forty million borrowers owe more than $1.73 trillion in student loan debt.

Payments resumed in October after the Supreme Court ruled an executive order to relieve student debt was unconstitutional. The average debtholder owes in the range of $200 to $299 a month.[5] Over the course of a year, this can add up to almost $3,600 less in average household budgets, significantly limiting discretionary spending for many Americans who have not had to make a payment since 2020.

The resumption of student loan repayments may have a significant impact on personal savings and adds another layer of difficulty for consumers trying to navigate an economy already riddled with inflation, high interest rates, and uncertainty.

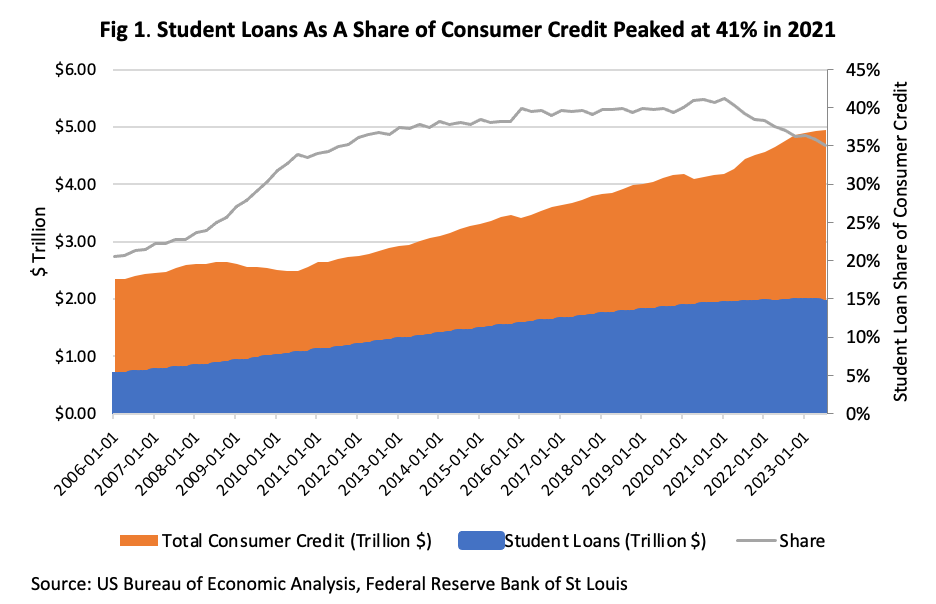

From 2013 to 2019, the monthly personal savings rate (PSR) hovered between five to ten percent (Figure 2). Nationwide lockdowns, shifts in spending patterns, and government-issued stimulus payments led to Americans paying down debt and increasing savings, and the PSR skyrocketed to 32%.

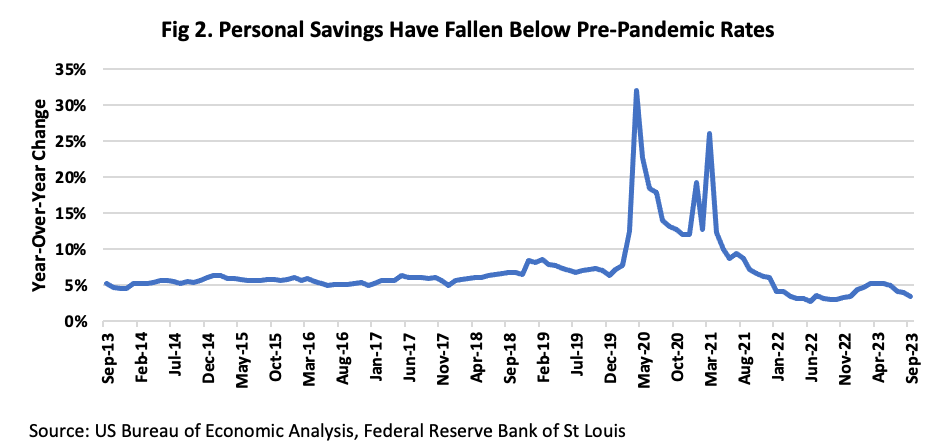

As lockdowns eased, Americans ultimately began to spend their increased savings. This is shown in the exceptionally strong year-over-year increases in retail sales in 2021 (Figure 3). But as the effects of recent inflation began to hit consumers, they started to tap into their savings to maintain spending levels and/or had to reduce their discretionary spending. Since March 2022, real consumer retail spending has experienced mostly negative year-over-year percent changes. The PSR has also dropped considerably below pre-pandemic levels, with a 3.4% reading in September 2023.

These shifts in savings suggest that consumer confidence and spending patterns have been affected by various recent economic factors such as inflation and higher interest rates, and the additional resumption of student loan payments may intensify these trends. As household budgets tighten to resume student loan payments, one economic indicator of particular interest is retail sales, especially as the holiday season approaches. A recent forecast predicts nominal holiday retail sales from November 2023 to January 2024 will increase between 3.5% to 4.6% compared to last year.[6] For context, the forecasted growth rate is almost half of last year's performance when holiday sales increased 7.6% and totaled $1.49 trillion from the previous year.

Borrowers may also have to delay more significant expenditures like buying a house or a vehicle due to the financial strain caused by the resumption of student loan repayments.[7] Industries (such as real estate and automobiles) that are already facing challenges due to relatively high interest rates could see further complications as potential buyers postpone these larger purchases.

State and local governments may also generate lower revenue from sales taxes due to shifts in spending patterns. As an example of the potential impact, Pennsylvania’s Independent Fiscal Office estimated reduced household disposable income from resuming student loan payments could lead to more than 35,000 job losses (full and part-time workers) and a nominal gross domestic product loss of $3.4 billion for the state. The research brief also estimates the impact on General Fund tax revenues could be a $180 million loss, including personal income, sales, and corporate net income taxes.[8]

Moving forward, it is evident that households with student loan debt will be rethinking spending and saving priorities, and those changes will ripple throughout the economy. Retail sales, personal savings, consumer credit, and other important economic indicators are monitored and tracked closely by Chmura’s team of economists and data scientists in order to gain an understanding of how they will impact both the national and local economies. To further explore how Chmura’s consulting team and JobsEQ® can be used to evaluate economic trends and impacts from the national level down to your zip code, contact Chmura today.

--------------------------------------------

[1] Source: https://studentaid.gov/announcements-events/covid-19

[2] Source: https://www.bestcolleges.com/research/college-enrollment-decline/

[3] In addition to education loans, consumer credit also includes car loans, credit cards, and personal loans. Mortgages and home equity loans are not included in Consumer Credit.

[4] In addition to education loans, consumer credit also includes car loans, credit cards, and personal loans. Mortgages and home equity loans are not included in Consumer Credit.

[5] Source: https://money.usnews.com/loans/student-loans/articles/average-student-loan-payment

[6] Source: https://www2.deloitte.com/us/en/pages/about-deloitte/articles/press-releases/deloitte-holiday-retail-sales-expected-to-increase.html

[7] See related Chmura blogs on this topic, https://www.chmura.com/blog/2014/july/08/economic-impact-college-students-carrying-high-student-loan-debt-and-not-buying-homes and https://www.chmura.com/blog/2017/july/06/economic-impact-student-loan-debt-is-rising

[8] Source: http://www.ifo.state.pa.us/download.cfm?file=Resources/Documents/RB_2023_06_Student_Loan_Repayment.pdf

Subscribe to the Weekly Economic Update

Subscribe to the Weekly Economic Update and get news delivered straight to your inbox.