Economic Impact: Signs of a Slowdown? Watch the Job Market, Which is Slowing Down

This article was originally published in the Richmond Times Dispatch on March 6, 2023.

Given the strength of the labor market and expectations by some for a recession in the later part of 2023, analysts are scrutinizing economic indicators for signs of a slowdown.

Job postings are a good indicator to watch because they are updated daily and are a leading indicator of employment trends since businesses don’t post job ads unless they expect demand for their goods and services to continue to increase.

Chmura’s Real Time Intelligence job postings showed a peak in active postings in the United States, Virginia, and the Richmond metro area during the week starting June 27, 2022. Since then, postings have dropped 17.1%, 13.9% and 18.1%, respectively, through the week starting February 13, 2023.

More recently, the decline in job posts accelerated since the end of January to mid-February suggesting further weakness in the job market. Job posts are down 6.7% in the nation, 4.2% in Virginia and 7.4% in the Richmond area over that period.

There are additional signs in job ads that the labor market has weakened over the past year. Job ads that are open for shorter timeframes can be an indicator of jobs being filled quicker due to more competition and fewer opportunities per job seeker. The median duration of job ads closed dropped dramatically in the nation in 2022 to 32 days from 41 days in 2021. However, the median duration in 2022 is fairly close to the median durations in 2019 and 2020, suggesting 2021 was the outlier with an especially tight labor market. It could be that the labor market is transitioning from fast recovery mode in 2021 to a more sustainable long term growth trajectory.

An increase in the practice of offering sign-on bonuses is also an indication of a tight labor market that has recently reversed trend. The offering of sign-on bonuses increased in popularity following the pandemic along with a rise in wages. In 2022, however, sign-on bonuses declined in popularity after peaking in the fourth quarter of 2021, which may be an indicator of slowing hiring competition.

Some of the overall decline in offering sign-on bonuses can be attributed to the decrease in ads for truck drivers in 2022, a popular occupation in job ads and one with a high-prevalence of sign-on bonuses. Nevertheless, sign-on bonuses also slowed among service occupations during this period, with the percentage of job ads offering the incentive slipping from 6.3% in the fourth quarter of 2021 to 5.4% in the fourth quarter of 2022. Sign-on bonuses for white-collar occupations inched up over the same period from 4.0% to 4.2%.

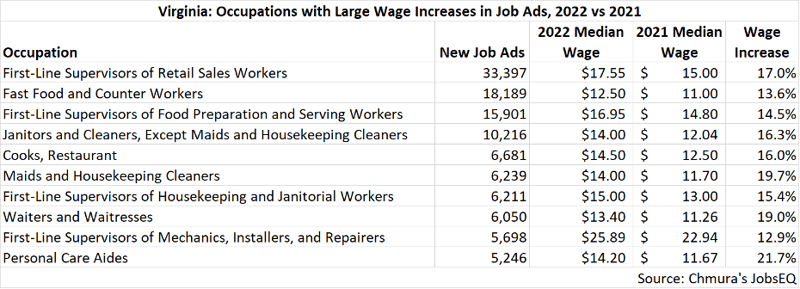

Despite some signs that the labor market is easing, wages have risen as employers attempt to offset some of the recent increase in inflation. Wages in 2022 made a substantial jump in Virginia and across the nation, particularly among lower-paying jobs. Prominent occupations with lower-than-average wages, such as those shown in the accompanying table, have been hard to fill and have seen a corresponding increase in compensation as employers attempt to fill these positions. Wages disclosed in job ads indicate double-digit percentage increases in pay that reflect some of the fastest growing increases in the state for these openings which include many food-service jobs (fast food workers, waiters and waitresses, and cooks) as well as maids and janitors.

Subscribe to the Weekly Economic Update

Subscribe to the Weekly Economic Update and get news delivered straight to your inbox.