Top 3 Locations for Wind Farms in the USA

President-elect Biden has promised to invest $400 billion over ten years in clean energy and innovation.[1] That means there may soon be extensive funding available for renewable energy firms looking to start-up, expand, or relocate.

But where is the best place to build a new wind power facility? Which sites have high-quality available labor? And which sites have access to the supply chains clean energy companies need?

We used LaborEQ, a site selection analytic in JobsEQ by Chmura, to answer those questions for the Wind Electric Power Generation (NAICS 221115) industry.[2] LaborEQ identifies the top sites by ranking them according to 12 factors that include labor availability, training pipeline, educational attainment, payroll, cost of living, supply chain, industry competitiveness, labor turnover, and union membership.

Here are the top metropolitan statistical areas (MSAs) in the United States for a mid-sized wind farm that employs 50 people, based on the 12 factors:

- Houston—The Woodlands—Sugar Land, TX MSA

- Dallas—Fort Worth—Arlington, TX MSA

- Brownsville—Harlingen, TX MSA

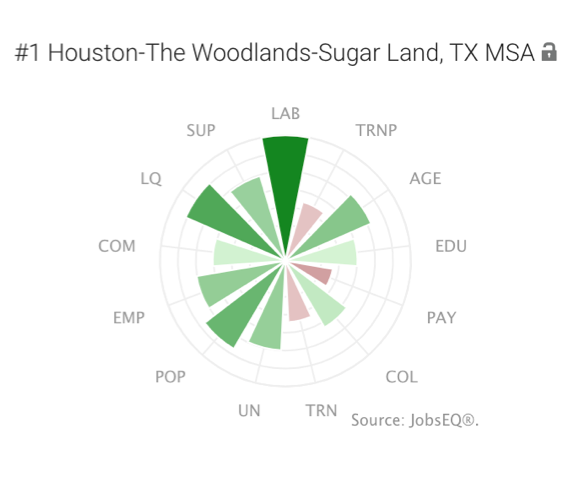

1. Houston—The Woodlands—Sugar Land, TX MSA

Strengths. Houston’s major strengths are its ready supply of available labor (LAB), a high location quotient (LQ), and strong population growth (POP). Labor availability (LAB) quantifies how many local employed or unemployed workers have the skills to perform the jobs needed at a wind power plant. For example, a new wind farm of this size, according to typical staffing patterns, will need to hire two electrical engineers. In Houston, there are 2,541 skilled candidates for each of these electrical engineer positions. The more candidates per job opening, the easier it will be to hire the right employees! Houston also has 33 candidates available for every needed wind turbine technician, the most in-demand occupation at a new wind farm.

Weaknesses. Labor costs are one of the biggest expenses for businesses, and Houston’s major weakness is its relatively high payroll costs (PAY). LaborEQ estimates that total payroll annual will cost $4.00 million in Houston, versus $3.79 million in Dallas or $2.84 million in Brownsville. If a new energy company cannot afford Houston’s payroll, it should consider choosing a different location.

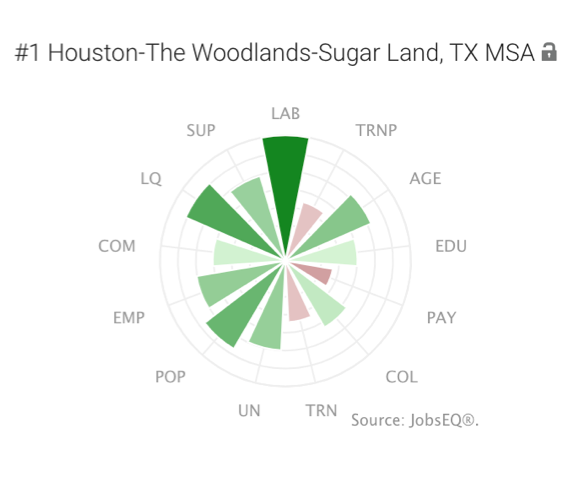

2. Dallas—Fort Worth—Arlington, TX MSA

Strengths. Dallas has strong labor availability (LAB), employment growth (EMP), and population growth (POP). Like Houston, Dallas has high number of electricians, electrical repairers, and supervisors who would be well qualified to work in a new wind power plant. Plus, the Dallas area is growing rapidly! The population of Dallas—Fort Worth—Arlington MSA is expected to grow by 1.3 million people by 2030.[3]

Weaknesses. Like Houston, Dallas’s payroll costs (PAY) are relatively high at $3.79 million per year. Further, Dallas has a relatively weak training pipeline (TRNP) for this specific industry, which means there is a low supply of postsecondary graduates from local schools in needed occupations.

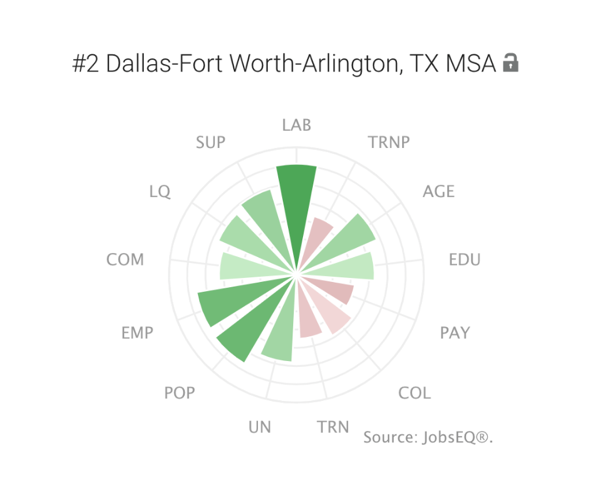

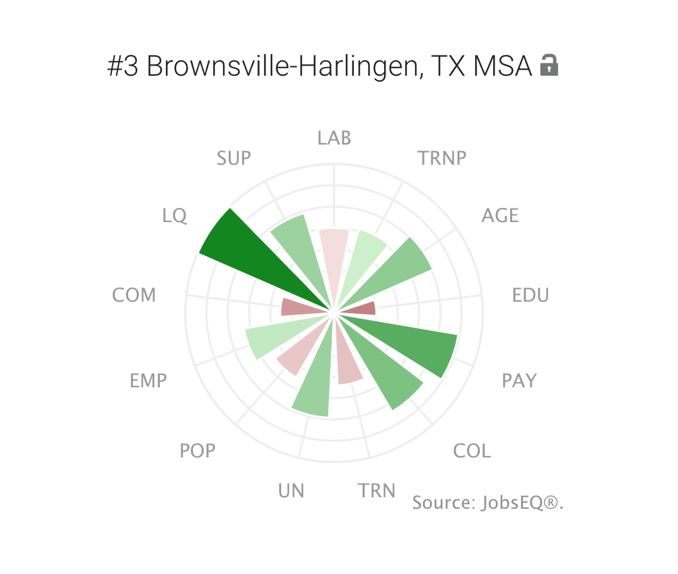

3. Brownsville-Harlingen, TX MSA

Strengths. Brownsville’s major strength is its high location quotient (LQ) and low payroll costs (PAY). Its high location quotient (LQ) of 21.62 means, for an area its size, the number of people employed in wind power in Brownsville is 21.62 times the national average! Location quotients compare the concentration of an industry within a specific area to the concentration of that industry nationwide.[4] Many people in Brownsville work in wind power due to the expansion of French energy company Engie to Brownsville in 2019.[5] Given Brownsville’s specialization in wind, it makes sense that they also have a strong regional supply chain (SUP) of industries that sell goods and services needed in solar and wind power.

Weaknesses. Relatively low levels of educational attainment (EDU) and subpar industry growth (COM)[6] are Brownsville’s weak points. However, given the low payroll costs and existing specialization in wind power, Brownsville is still a great place for a new clean energy firm.

National Labor Market Information

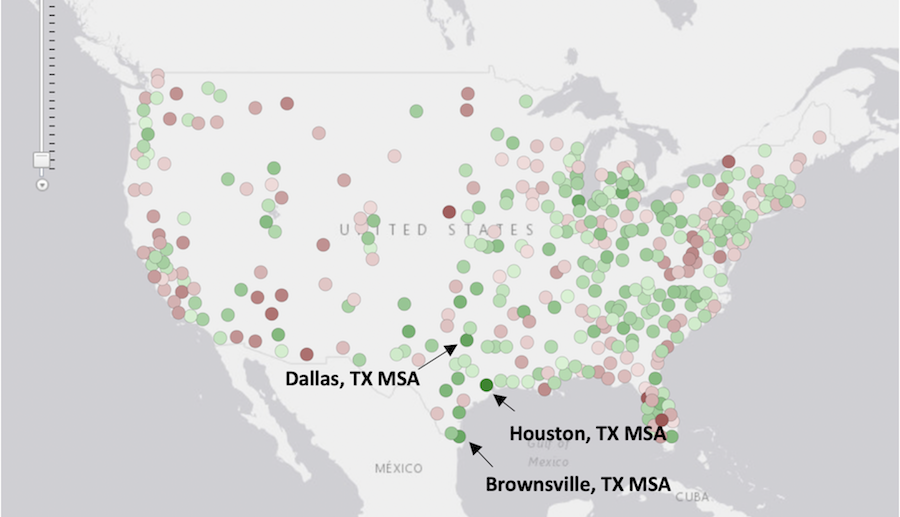

In this map, each dot represents a potential site for a wind farm. The darker green dots represent the best sites, where the red spots are sites least suited to a new wind farm.

Clean energy companies must carefully analyze local labor market conditions before deciding to expand or relocate operations. Not every large MSA is well suited. For large projects, it may make sense to also hire a site selection consultant.

Future government investment means the future is bright for wind power generation, especially in Houston, Dallas, and Brownsville.

LaborEQ is a tool that makes site selection analysis easy. Whether you are a site selection analyst or the head of a growing energy firm, LaborEQ will make sure you choose the perfect site. Contact us to see a demo of LaborEQ today.

[1] https://www.forbes.com/sites/rrapier/2020/09/06/the-highlights-of-joe-bidens-energy-plan/?sh=67224b433bfe

[2] NAICS Codes, or North American Industry Classification System Codes, is the standard used by federal statistical agencies in classifying business establishments . You can find more details on Wind Electric Power Generation—221115 US Bureau of Labor Statistics website here: https://www.bls.gov/oes/2018/may/naics5_221115.htm

[3] Population projections per JobsEQ.

[4] https://www.bls.gov/cew/about-data/location-quotients-explained.htm

[5] https://www.chron.com/business/energy/article/French-energy-company-Engie-debuts-new-wind-farm-14372071.php

[6] Industry growth, or competitiveness, for this purpose is measured via a historical shift share analysis.

Subscribe to the Weekly Economic Update

Subscribe to the Weekly Economic Update and get news delivered straight to your inbox.