The Probability of a Recession in Late 2022 is Over 50%

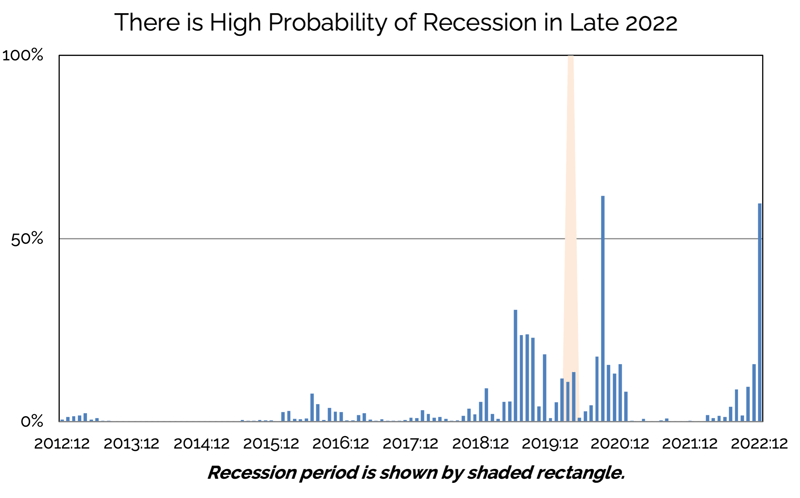

Gross domestic product (GDP) recently contracted in the 1st quarter of 2022, with the economy declining at a 1.6% annual rate after increasing 6.9% in the 4th quarter of 2021. Both trade and inventory investment contributed to this recent decline. As recession fears loom, the probability of a recession in Chmura’s model jumped up to 60% through December 2022.[1]

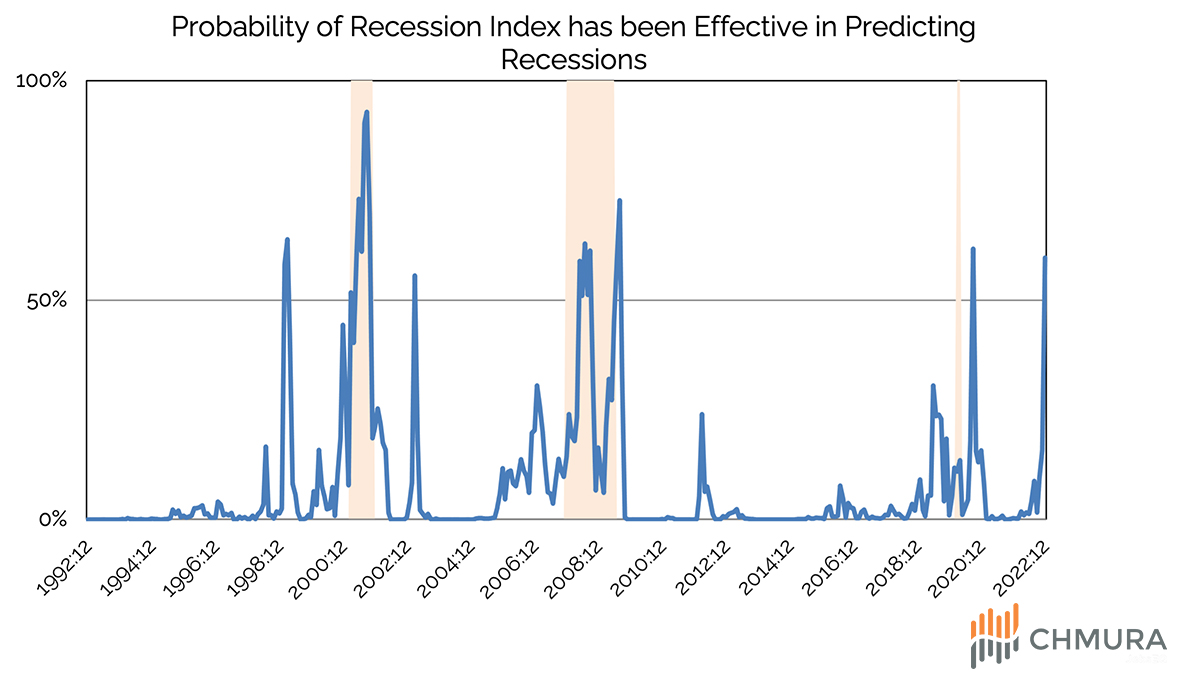

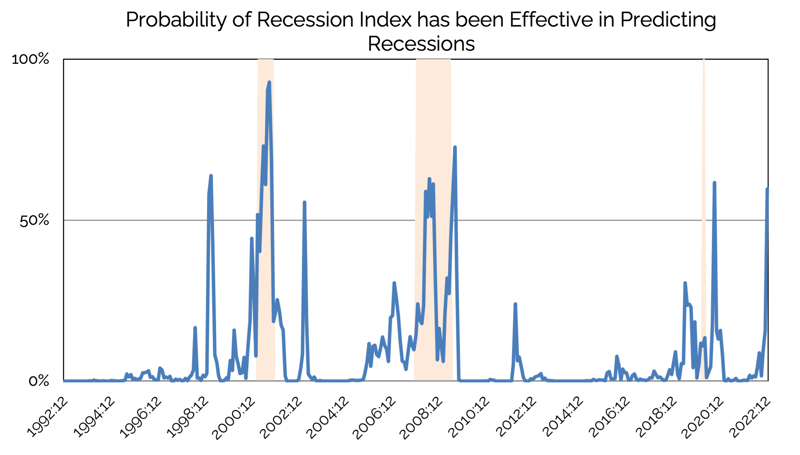

Chmura’s recession probability model uses the consumer price index, the spread of the Treasury curve, volatility in the Treasury curve, and the S&P 500 to predict when financial conditions are ideal for recession. A single month of elevated probability provides a warning that the economy is likely to slow. A sustained six-month period of greater than 50% probability establishes a clear sign that has historically been associated with recession. This recession probability model has been successful at predicting the last two U.S. recessions before the Covid-induced recession as shown in the chart below. Official recession dates, established by the National Bureau of Economic Research, are represented by the shaded areas in the chart.

The increase in the consumer price index and higher interest rate volatility in the past month both contributed to this increase in recession probability. The largest factor is the steep decline in the S&P 500 between May and June.

-----------

[1] In the past, a 50% probability has been associated with a recession.

Subscribe to the Weekly Economic Update

Subscribe to the Weekly Economic Update and get news delivered straight to your inbox.